For the past 20 years, we have helped many private businesses successfully create and support a demand-driven, private equity market for their businesses using True Corporate Model™ concepts. These businesses are from a variety of industry segments. The following three stories illustrate success that can be accomplished by following the True Corporate Model™ concepts.

Personal Service Business

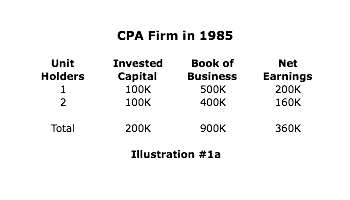

In 1985, a CPA firm had two partners (ages 36 and 37), 10 staff, gross revenues of $900K and net annual earnings to partners of $360K. See Illustration #1a. The two partners had a buy-sell agreement that triggered in the event of death or disability of either partner. They needed to address two issues. First, both were working 50+ hours per week so the likelihood of either partner purchasing and retaining the other’s book of business was rather remote. Second, two younger CPAs were pressing to become partners in the CPA firm. If the two founding partners followed a traditional approach for admission of CPA owners, there was room for only one.

The two founding partners decided to not follow the traditional approach, made both of the younger CPAs new owners in the CPA firm and established True Corporate Model™ concepts for management of the firm. They eliminated other barriers to ownership, such as the requirement for an owner to be a CPA. These changes helped the CPA firm recruit and retain many qualified professionals who would have otherwise been lost following a traditional approach. Empowerment experienced following the True Corporate Model™ helped the CPA firm grow to 90 total personnel in three offices with 12 owners.

The two founding partners decided to not follow the traditional approach, made both of the younger CPAs new owners in the CPA firm and established True Corporate Model™ concepts for management of the firm. They eliminated other barriers to ownership, such as the requirement for an owner to be a CPA. These changes helped the CPA firm recruit and retain many qualified professionals who would have otherwise been lost following a traditional approach. Empowerment experienced following the True Corporate Model™ helped the CPA firm grow to 90 total personnel in three offices with 12 owners.

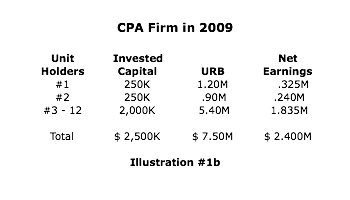

In 2009, the two founding partners sold their respective interests to a younger generation of owners. Immediately prior to their retirement, the CPA firm had tangible asset invested capital of approximately $2.5M, gross revenues of more than $8.0M and net annual earnings to partners of approximately $2.4M. In a unique structure for personal service businesses, the CPA firm’s intangible value was separated from the units of ownership so each partner could be rewarded for their individual contribution to the CPA firm’s growth over time. Intangible value is paid to retiring partners as Unfunded Retirement Benefits (URB). Retiring owners are paid for their interest in tangible asset invested capital over 5-years and URB over 10 years. See Illustration #1b.

Construction Business

Construction Business

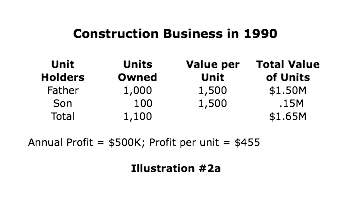

In 1990, a construction business was owned by a father (age 55) and son (age 35). The business had gross revenues of approximately $5.0M, net pre-tax income from operations of approximately $500K and business offices in two states. In addition to the son, the construction business had two other key manager level employees who were at least 15 years younger than the father. These two were not related to the father and son. The three key employees earned average compensation, including bonuses, of approximately $85K per year. The business was feeling the stress of an owner who was tired of day-to-day management and tired of leaving most of his after-tax profits in the business to finance growth. See Illustration #2a.

The father did not believe the three key employees were qualified to be buyers of the business, but realized that his only other alternative was to close and liquidate the business on his retirement. Few, if any, of the construction business’s competitors were viewed to be qualified buyers and there was a reluctance to approach these few due to fear of unfair competition if the no sale resulted. The three key employees held many entrepreneurial attributes similar to the father. To become qualified business owners, the key employees needed an opportunity to grow into full entrepreneurs by following a path similar to that experienced by the father.

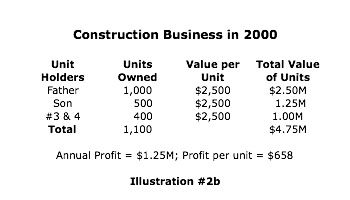

A sale of 200 units to the key employees was structured and True Corporate Model™ concepts were implemented. Funds from the sale of units were used to finance business growth. Shortly after the sale of units, management responsibilities were changed so the key employees took over more executive level management roles and the father became Chairman of the Board of Directors and a mentor to the key employees. The father found the mentor role to be a new challenge, which he enjoyed. With real skin in the game from key employees, the business’s gross revenues and net profits grew quickly. The key employees were able to pay off bank loans obtained for their first purchase of units with annual unit dividends and increased bonuses. A second sale of 600 units to the key employees was structured four years after the first sale of units.

By 2000, annual construction business gross revenues were more than $20.0M, net pre-tax profits were more than $1.25M and 90% of annual profits were distributed as unit dividends. The father died unexpectedly in 2002, the key employees worked with the fathers heirs to manage the business until units held by non-active family member could be purchased by the key employees. See Illustration #2b.

Temporary Employment Agency

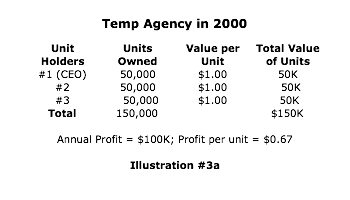

In 2000, a temp agency had 3 equal owners each contributing cash capital of $50,000. The agency had approximately $2.0M annual sales and $100K in net pre-tax profit. One owner (age 40) worked full-time in the business as its CEO. The other two owners (ages 50 and 51) were equity capital investors and members of the agency’s Board of Directors with significant experience managing with True Corporate Model™ concepts . The agency had three branch offices managed by three sales managers who seemed to be more motivated by their respective commission income than gross revenue or net profit goals or the agency. The agency also had no management transition plan and was at risk if something happened to its CEO. See Illustration #3a.

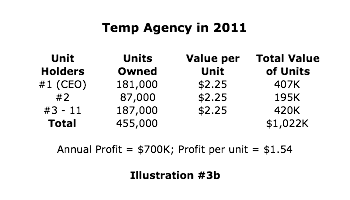

The three owners offered units of ownership to the branch managers and taught them benefits to all for adopting True Corporate Model™ concepts for the agency. Annual net pre-tax profits per branch office increased significantly in the first year. The agency was able to recruit additional top level branch office and corporate level managers. Additional units were sold to the management owner and other key employees as rewards for individual excellent performance. Since more key employees want to purchase units what is available, a true demand market for units was created. Earnings increased each year until 2008. Earnings for 2008 and 2009 were substantially reduced by the recession. The True Corporate Model™ process empowered managers and other key employees with skin in the game to be creative, helping the agency survive its two toughest years and getting the agency quickly back on track.

For 2011, the agency operates with seven branches in three states and has plans to own a new branch office in a fourth state. It expects gross revenues to approach $10.0M and net pre-tax profits to be the highest ever at approximately $700K. Units of ownership were valued at $2.25 per unit in 2011because of a three-year weighted average approach to valuation. If profits average $1.54 per unit for a sustained period, future unit values will approach $4.50 per unit. See Illustration #3b.