True Corporate Model™ – The Value Proposition

This is a proven concept that teaches owners and key employees of private companies how to create and maintain a demand-driven market for their company’s equity. The True Corporate Model™ concept helps private business owners break away from Control Model business management systems that limit the private business’s capacity for revenue, profit and equity value growth over time.

Most of America’s successful private companies are controlled by owners who are in their 50’s to 60’s with no formal transition plan. Most 50 to 60 year old business owners expected to retire before age 65 with the ability to live comfortably during their retirement years. Proceeds from the sale of the private business are a significant part of most successful private business owners’ retirement investment capital.

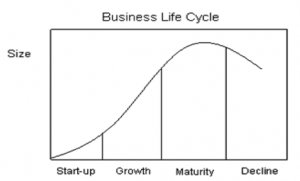

The life cycle of a typical successful private business follows the pattern illustrated below. A successful private business usually grows past its highest success point into decline before it sells or liquidates. This is primarily because private business owners grow tired of day to day management after 20 to 30 years of the same routine and become more risk adverse after age 50.

This is not the life cycle pattern of publicly traded businesses who maintain succession plans for management and perpetual demand-driven markets for their companies’ equity.

Changing Times Make the TCM Value Proposition More Valuable

Principal private business owners are less likely today to sell their business interests before age 65 for the following reasons:

- People are living longer. With more people expected to live to 80 and 90 years old, how much retirement capital is needed to provide retirement income and security for 20 to 30 years?

- Income taxes consume 25% to 30% of the gains realized from selling a private business, at today’s capital gains rates. Will tax rates go up in the future for successful principal private business owners? How will this change the amount of retirement capital needed to provide retirement income and security for 20 to 30 years?

- Small, successful private businesses typically provide an annual pre-tax return on owners’ equity capital investment ranging from 22% to 28%. So, why sell a successful business, give 25% to 30% of the hard earned private company equity for Federal and State income taxes, and then invest in publically traded securities with much lower annual returns, typically ranging from 4% to 12% on average per year depending upon the level of risk assumed?

- Health insurance costs are lower when paid with pre-tax dollars through a group insurance plan. Continued business ownership beyond age 65 allows business owners to continue to receive better and cheaper business group health insurance benefits.

The Demand-Driven Private Equity Market

One of the best markets for most successful private companies’ equities can be a sale to key employees who understand the business’s strengths, weaknesses and inherent value. Problem, many times the key employees are not perceived by the principal private business owners or the business’s bankers and vendors to be qualified buyers. Key employees can become qualified buyers, however, by following a True Corporate Model™ process for a period of 5 to 10 years from when the concepts are initiated. Transition of day to day management responsibilities to key employee owners typically occurs sooner. New ownership is sold to key employees to finance growth, which allows the original owners to withdraw their share of annual profits from the business. Demand comes when more key employees wish to purchase units of ownership than what is available. That focuses more key employee attention to growth and retention of business to increase opportunities to purchase. Growth increases unit values on an annual basis, which also increases demand to purchase more units before the values go up.

The “True Corporate Model™” Concept

The True Corporate Model™ concept is not an estate plan for transferring wealth to a second generation of family members. Key employees may or may not include family members of the principal owners. It is also not an ESOP. Ownership opportunities are purposely given on a discriminatory basis to persons with the highest potential for entrepreneurial tendencies needed for continuing the business.

The True Corporate Model™ process:

- a) empowers participative decision making and risk sharing;

- b) grows key employees into qualified entrepreneurial buyers;

- c) creates an annual dividend paying culture;

- d) increases enterprise value;

- e) and creates a generational demand-driven market for the private company’s equities.

By following these concepts, owners of the private companies can continue ownership beyond age 65 and eventually sell their equity interest at a more favorable price to the key employees.

Following the True Corporate Model™ does not dilute the founding owners’ earnings per share or value per share. To the contrary, through empowerment of key employees, it typically enhances both earnings per share and value per share, as it reduces the principal private business owners’ overall business risks during continued ownership.

True Corporate Model™ is not a novel concept. It implements generally accepted US free enterprise business principles that have evolved over two centuries and eliminates the restrictions and limitations imposed by a Control Model system for governing the private business.

To learn more about the True Corporate Model™ and to get a free consultation and proposal for your successful private company, please call or e-mail the TCM Consulting Network™.

July 11, 2011

Copyright 2011 David M. Cooper, CPA, PA. All Rights Reserved.

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by copyright law. For non-personal use or to order multiple copies, please contact Dave Cooper at 1-208-899-4666.